[ad_1]

FTSE 100 touches one-month low

Britain’s stock market isn’t joining in the party this morning.

The FTSE 100 has hit a one-month low of 5916 points in early trading (down 47 points or 0.75%). That’s its lowest level since the start of August.

That’s partly due to the stronger pound, and also because the City is catching up with Monday’s European losses after the bank holiday break.

Travel companies are among the big fallers, with British Airways owner IAG down 6% and jet engine maker Rolls-Royce losing 6.7%.

Mining companies are rallying, though, as the jump in Chinese factory growth could lead to more demand for commodities.

On the smaller FTSE 250 index, travel ticket vendor Trainline has plunged by 8% as many worker resist the government’s efforts to lure them back to the office. Property developer Hammerson has lost 5%.

Updated

European markets rally

European stock markets are rallying this morning, helped by the pick-up in growth at China’s factories.

The Europe-wide Stoxx 600 index has gained 0.3%, recovering some of Monday’s losses, on optimism for the global economic outlook.

Germany’s stock market is leading the way, lifted by exporters such as pharmaceuticals firms Bayer (+1.8%) and Merck (+1.5%) and carmaker BMW (+1.7%).

Chipmaker Infinion (+1.75%) is also rallying on reports that Apple has told suppliers to make at least 75 million 5G handsets to launch later this year.

- German DAX: up 99 points or 0.77% at 13,045

- French CAC: up 18 points or 0.4% at 4,956

- Italian FTSE MIB: up 174 points or 0.9% at 19,804

- Spanish IBEX: up 13 points or 0.2% at 6,983

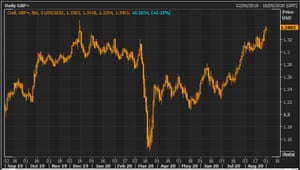

Pound jumps over $1.34 as dollar struggles

In the currency markets, the pound has hit its highest level of the year against the US dollar.

Sterling sprang, gazelle-like, over the $1.34 mark this morning, for the first time since December 2019.

The pound vs the US dollar over the last year Photograph: Refinitiv

The euro is also rallying against the dollar, hitting $1.1966 for the first time in over two years.

The dollar continues to be dragged down by last week’s pledge by US central bank chief Jerome Powell not to tighten monetary policy if inflation rises.

Powell’s new softly-softly approach to inflation is being seen as a sign that US interest rates will remain low for a long time, which is bad for the dollar (but probably good for growth, which is why Wall Street is back at record levels).

A silk factory on the outskirts of Jammu, India. Photograph: Channi Anand/AP

India’s factories have returned to growth for the first time in five months, bolstering optimism this morning.

Indian manufacturers have reported that production volumes and new work both increased last month, lifting the sector back to growth.

Data firm IHS Markit reports:

The upturn was led by an improvement in customer demand as client businesses reopened, after lockdown restrictions eased amid the coronavirus disease 2019 (COVID-19). Output and new orders expanded at the fastest paces since February. Meanwhile, job cuts continued into August, extending the current sequence of decline to five months.

This has pushed Markit’s India manufacturing PMI to 52.0, from 46.0 in July – back into growth.

BloombergQuint

(@BloombergQuint)India manufacturing PMI returns to expansion zone in August.

Read more: https://t.co/BkSjTHpnNM pic.twitter.com/TtPBGYl46s

Green shoots at South Korea’s factories

A street in Jongno, usually one of the busiest districts in Seoul, was quiet last night after people were advised to avoid pubs and bars Photograph: YONHAP/EPA

Over in South Korea, factory output continued to fall last month, but at a slower rate.

The South Korean manufacturing PMI rose to 48.5 in August, up from 46.9 in July. That’s the best reading in six months, but still slightly below the 50-point mark showing flat growth.

That’s encouraging news for Seoul, just as new strict social distancing restrictions were brought in to fight a worrying rise in Covid-19 cases.

Tim Moore, director at IHS Markit, reckons the sector has reached a turning point.

The latest Manufacturing PMI reading was the highest since February and pointed to only a modest deterioration in overall business conditions.

Subdued global economic conditions due to the COVID-19 pandemic continued to hold back customer spending in August, but there were a number of reports citing a boost to demand from the return to work among clients in the US and Europe

IHS Markit PMI™

(@IHSMarkitPMI)Manufacturers in South #Korea continued to signal an overall downturn in business conditions during August, according to #PMI data, but the rate of decline continued to ease in comparison to that seen through Q2. https://t.co/E7daRJOOre pic.twitter.com/XEaKMzra7c

Although today’s PMI report is strong, there is one small cloud – China’s factory bosses are less optimistic than a month ago…..

Caixin says:

Although firms generally expect output to rise over the next year, the degree of optimism edged down to a three-month low in August.

While many companies anticipate global economic conditions to improve further, many expressed concerns over how long the pandemic would impact operations and customer demand.

Reuters has further evidence that China’s manufacturing is strengthening:

A mirror factory in the Chinese city of Yiwu, which supplies to retail giants such as Walmart and Home Depot, has been inundated with new business beyond the factory’s current operating capacity, with the management sending the entire sales team down to factory floors, a 23-year-old salesman at the company told Reuters.

“We laid off workers when the pandemic first started but now, with this many orders, we cannot find enough people,” said the salesman, adding that the firm was having issues booking shipments as finished goods piled up at their warehouses.

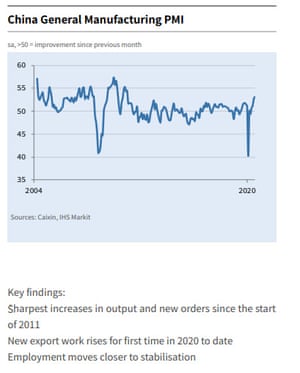

Introduction: China’s PMI strongest since 2011

A worker inspecting an elevator signal system at a factory of Jiangsu WELM Technology last month Photograph: REX/Shutterstock

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

China’s factories have got September off to a strong start, by reporting the strongest growth in almost a decade.

New export orders jumped last month, for the first time since the Covid-19 pandemic began, suggesting a pick-up in global demand. This has helped manufacturers to expand production at a faster rate than in July.

And with overall new orders also up, the slump in Chinese factory employment has also eased.

That’s all according to Caixin’s monthly survey of purchasing managers across the Chinese economy. This PMI index has jumped to 53.1 for August, up from 52.8 in July, showing the strongest increase in activity since January 2011.

China’s manufacturing PMI has now been in positive territory (over 50) for four months in a row, as the economy recovered from the disruption caused by the coronavirus outbreak.

Chinese factory PMI data Photograph: Caixin/Markit

Dr Wang Zhe, senior economist at Caixin Insight Group, says the momentum of the recovery remains strong, as stronger overseas demand encouraged factories to restock their supplies and stop laying off workers.

Wang adds:

“Overall, the post-epidemic economic recovery in the manufacturing sector continued. Supply and demand expanded with the pickup in overseas demand. Backlogs of work continued to increase. Both quantity of purchases and stocks of purchased items also grew. Companies’ future output expectations remained strong, reflecting a positive outlook for the manufacturing sector for the year ahead. Employment remained an important focus.

An expansion of employment relies on long-term improvement in the economy. Macroeconomic policy supports are essential, especially when there are still many uncertainties in domestic and overseas economies. Relevant policies should not be significantly tightened.”

South Korea and India have also reported improved PMIs this morning (more in a moment), in a sign that Asia-Pacific economies had a decent August.

European stock markets are expected to rise on the back of this, apart from the UK – which needs to catch up with yesterday’s losses following Monday’s bank holiday break.

IGSquawk

(@IGSquawk)European Opening Calls:#FTSE 5950 -0.24%#DAX 13016 +0.54%#CAC 4969 +0.45%#AEX 552 +0.49%#MIB 19739 +0.53%#IBEX 7023 +0.76%#OMX 1775 +0.48%#STOXX 3292 +0.58%#IGOpeningCall

FTSE back from holiday.

We should get confirmation this morning that the UK and US factory sectors strengthened last month, and that eurozone manufacturing slowed (at least, that’s what the ‘flash’ readings last month showed).

The agenda

- 8.55am BST: German unemployment figures for August

- 9am BST: Eurozone manufacturing PMI survey for August – expected to drop to 51.7 from 51.8, showing slower growth

- 9.30am BST: UK manufacturing PMI survey for August – expected to rise to 55.3 from 53.3, showing faster growth

- 9.30am BST: UK mortgage approvals and consumer credit figures for July

- 10am BST: Eurozone inflation for August

- 1pm BST: Brazil’s GDP for Q2 2020

- 2.45pm: US manufacturing PMI reports – expected to rise to 53.6 from 50.9, showing faster growth

Updated

[ad_2]

Source link