[ad_1]

Mark Sweney

Retailers French Connection, Naked Wines and Hotel Chocolat have reported surging digital sales as consumers turned to online channels during the nationwide lockdown.

Hotel Chocolat has said that digital sales rose over 200% in the quarter to the end of June and sales of subscriptions or recurring purchases, such as refills for in-home hot chocolate makers, grew 47%.

However, with its 125 stores across the UK closed for 12 weeks, including the key periods of Easter and Mother’s Day, overall revenues fell 14% year-on-year to £45m in the six months to the end of June.

A Hotel Chocolat shop in Victoria, London. Photograph: Philip Toscano/PA

French Connection, which operates websites in the UK and USA, has reported digital sales up 24% over the last 15 weeks.

The company said that following the re-opening of stores on 15 June in-store sales have been low “although conversion of those customers actually in the stores has been better than in the prior year”.

With pubs and restaurants closed online alcohol sales have boomed with Naked Wines reporting a 77% increase in sales in the quarter to the end of June.

In a trading update the company described itself as a “long-term winner” from the shift of consumer demand from buying wine in physical stores to digital channels.

The company also said that John Walden, Naked Wines chairman, is to leave at the the company’s annual meeting on 6 August due to personal reasons.

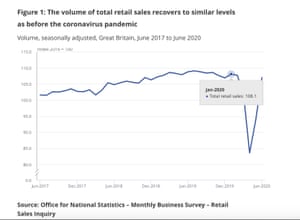

As it stands, UK total retail sales are just 0.6% lower than February pre-Covid lockdown levels in February.

Fresh data from the ONS shows UK retail sales rebounded in June. Photograph: ONS

But while the sector is clearly starting to recover, it’s worth remembering that Q2 retail sales were still down -9.5%, which is the weakest quarterly figure ever recorded.

ONS deputy national statistician Jonathan Athow comments:

Retail continued to recover from the sharp falls seen in April, with overall sales now almost back to pre-pandemic levels. But there are some dramatic differences in sales across the retail industry.

Food sales continue above their pre-pandemic levels due to the closure of cafes, restaurants and pubs. Online sales have risen to record levels, and now count for £3 in every £10 spent.

On the other hand, clothing sales remain depressed and across the high street sales in non-food stores are down by around one-third on pre-pandemic levels.

The latest three months as a whole still saw the weakest quarterly growth on record.

It looks like the retail jump was helped again by the DIY and home improvement lockdown trend.

What’s interesting here is that shops dealing in hardware, furniture and appliances saw sales rebound to near-pre-lockdown levels:

Office for National Statistics (ONS)

(@ONS)In June 2020, electrical household appliances, hardware, paints and glass and furniture stores all returned to similar levels as before the pandemic as home improvements during lockdown helped boost their sales https://t.co/NIrHEvMg9D pic.twitter.com/DKoGrcrQBE

And it looks like UK shoppers ditched some of their online shopping for physical stores once restrictions were lifted.

The ONS says the proportion of online sales retreated from its record peak in May:

Office for National Statistics (ONS)

(@ONS)The proportion of online spending reduced to 31.8% in June when compared to the record 33.3% reported in May, but is a considerable increase from the 20.0% reported in February https://t.co/EEqkBNmiKQ pic.twitter.com/YMzTVGT7Tx

Introduction: UK retail sales beat forecasts in June

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

We’re starting the day off with some relatively positive news for the high street, after fresh data showed that the easing of lockdown in England last month helped UK retail sales beat forecasts in June.

The Office for National Statistics has reported a 13.9% month-on-month rise in UK retail sales last month, which easily exceeded expectations for an 8% uptick.

And even the year-on-year contraction of -1.6% was smaller than forecasts for a -6.4% fall.

As former Bank of England policymaker Andrew Sentance notes, this is the most positive sign of recovery we’ve seen since the Covid-19 outbreak.

Andrew Sentance

(@asentance)Strong rebound in UK retail sales reported in June as lockdown eases. Volume of sales up 13.9 percent on May and – excluding motor fuel 1.7 percent UP on a year ago. The most positive recovery indicator for UK we have seen so far.

It came after further lifting of lockdown measures in England, with stores starting to re-open in mid-June.

We’ve got a relatively busy day on the data front, with flash eurozone, UK and US PMIs for July expected over the next few hours.

The agenda

- 9.00am BST: Eurozone flash composite PMI for July

- 9.30am BST: UK flash composite PMI for July

- 1.45pm BST: US flash manufacturing and services PMI for July

[ad_2]

Source link